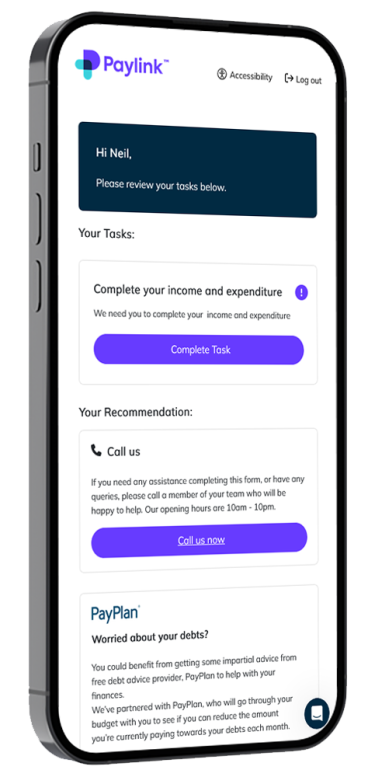

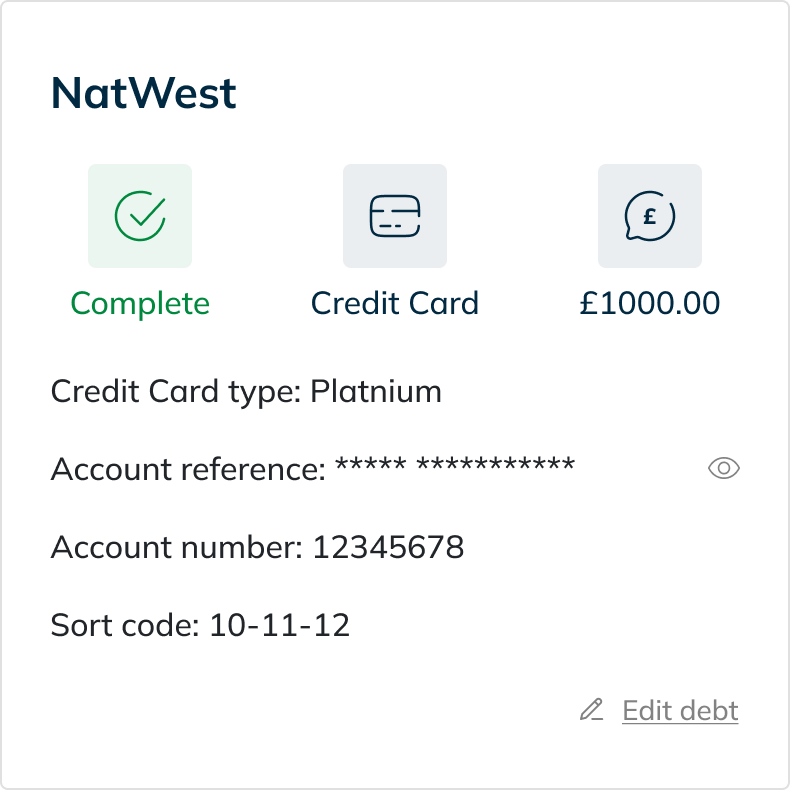

Customers will save time and reduce hassle of dealing with multiple financial insinuations.

We test our products rigorously, in-house, before offering them to the wider market. We also understand the crucial role that regulators play in our industry. We make sure that all of our platforms are developed in strict adherence to the rules set out to regulate the industry in which it will be used.

When you combine expertise, fair mindedness and, tireless dedication to customer experience; the result is a company which showcases the very best that modern financial technology has to offer.