We’re delighted to be working with Credit Kudos to provide a more secure and efficient way for clients to provide financial information using Open Banking.

Through Open Banking, our clients can provide their details electronically, rather than having to manually input these details and upload documents.

Susan Rann, CEO of Paylink Solutions said: “Credit Kudos technology provides a solution to engage with customers accurately, quickly and securely. Our clients can now collect the right information from their customers and third party organisations whilst providing transparency and accountability throughout the whole journey.”

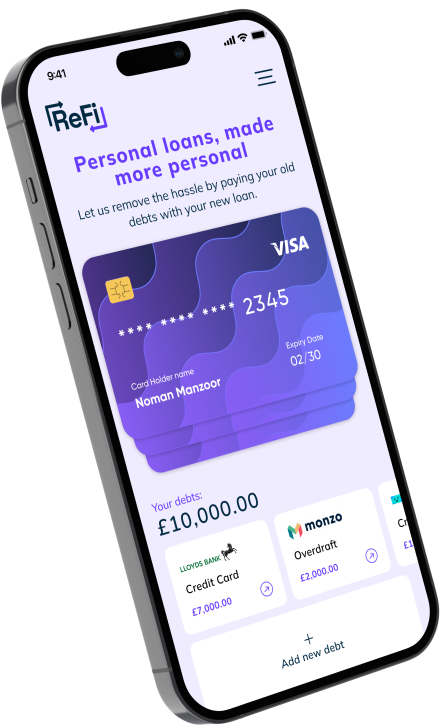

Our clients can use Open Banking technology to directly access their digital bank statements through its Embark software. APIs automatically populates people’s initial income and expenditure information – ready for them to check, amend if necessary and then submit. Documents can also be sent electronically, or uploaded via a drag-and-drop tool.

Freddy Kelly, CEO of Credit Kudos comments: “Credit Kudos is obsessed with creating easy-to-use technology for the best customer experience possible. Open Banking offers the opportunity to both improve the credit underwriting process and significantly increase the speed and ease of applying for a loan.

We share Paylink’s commitment to innovation in lending, and are excited to extend the benefits of Open Banking technology to Paylink’s customers. Our partnership will make easier and simpler for individuals to interact with financial institutions.”