We’re now working with Leeds Building Society to help mortgage customers who may be facing financial difficulties.

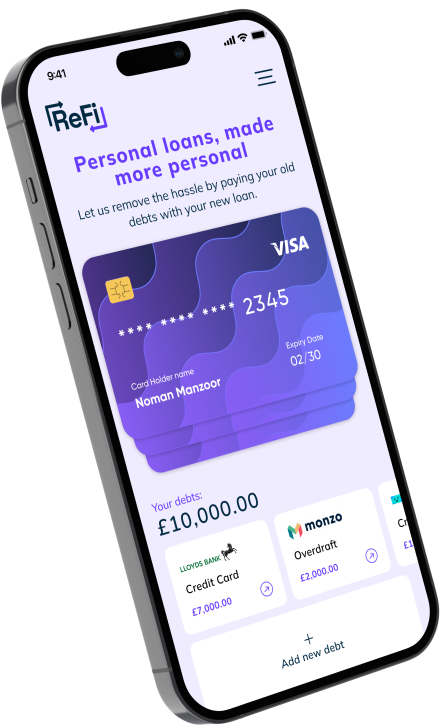

The building society has adopted our flagship product Embark to obtain a clear and accurate picture of a borrower’s financial situation quickly and digitally.

“In response to the challenges brought by the pandemic, we’ve been working hard to support our members and help them to manage their finances,” said Jaedon Green, Chief Customer Officer at Leeds Building Society.

“For borrowers at risk of financial difficulties, this means agreeing with them on the best solution to meet their personal circumstances – so swift and accurate information is vital.”

Customers are able fully self-serve via a secure online portal and upload personal information for the building society to assess. Customer support is also available. With this information Leeds Building Society can better understand the individual’s needs and identify suitable support.

As part of this journey, customers can also either request or extend payment holidays or set up new arrangements.

Our CEO, Susan Rann, said: “We’re really excited to be helping Leeds Building Society and have customised Embark so customers are provided with the financial support they need.

“Paylink Solutions is working with an increasing number of banks and building societies to provide more digitally-focussed customer support. We’re delighted with the positive impact Embark is having on thousands of customers across the UK every day.”

Get in touch now to see how Paylink Solutions can benefit your business.