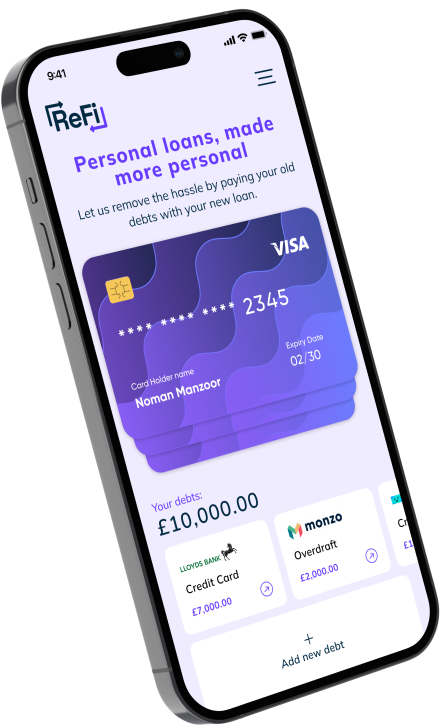

With greater regulatory focus from the FCA, Ofwat and Ofgem to do more to support customers struggling with cost-of-living pressures, firms have been reviewing processes for how best to understand their customers’ affordability. Increasingly, firms are looking to utilise external software, such as our Embark product, to support this process – whether it’s a customer self-serving in their own time to build an income and expenditure or an agent or adviser taking a customer through the process on the phone.

There has been a real focus on improving the efficiency and accuracy of that process and more and more firms are recognising that integrations such as Open Banking, CRA data pulls, benefits assessments and automated debt advice referrals all have a part to play. Not only do they allow for an improved overall customer experience, but they also drive down cost and increase productivity.

Of course, building a better understanding of a customer’s situation isn’t just limited to understanding their finances. Regulation across all sectors has focused heavily on identifying vulnerabilities and recognising a customer’s additional support needs. More and more firms are focused on how all of this can be brought together into a simple, straightforward journey, that can support the customer with their wider, more holistic needs. How can you capture the right data and use it more intelligently, above and beyond simply understanding what customers can and can’t afford to pay?

At Paylink Solutions, we find ourselves in a unique position. Working with our clients across multiple sectors gives us a privileged view on what is being gathered – financial or non-financial – and how it’s being used. This, coupled with our decision engine, means we can support our clients in delivering tailored, data-driven outcomes for their customers across sectors such as financial services, utilities, housing and debt advice. Although solutions across different sectors may differ, the overall drive and intention to achieve better outcomes is the same: to support more customers, and to do this more effectively and efficiently whilst continuing to gain and learn from customer insight.

We’re doing more and more to support clients across sectors to gather the right data and deliver multiple outcomes for their customers. Here, our Director of Development and Partnerships, Andrew Alder, outlines some examples of how the data captured through our Embark platform is being used by our clients:

- The FCA’s guidance on supporting existing mortgage borrowers includes guidance on providing forbearance at scale. By allowing lenders to access data through API endpoints or through our reporting services, they are able to identify and segment their customer base appropriately. For example, segmenting those customers where a temporary interest only or increased mortgage term is the right outcome for them. The ability to access the data in this way allows lenders to provide these types of outcomes digitally and proactively for the first time.

- With Ofwat’s call to action to ease the cost-of-living pressures, more water companies are now looking to utilise customers’ affordability data, overlaid with vulnerability or support needs data, to improve how they promote and offer their social tariffs and schemes. Using Embark’s decision engine to build their own decision logic into the affordability process helps water companies to automate social tariff outcomes and increase the number of customers being accepted onto schemes.

- Energy providers are using Embark and linking its data to their own data, to help them automate both repayment plans, direct debits and energy grant decisions.

- Although Priority Services Registers (PSR) are used collectively across the energy and water sectors, each company manages and maintains its own. In line with an improved customer experience, we’re now seeing demand from clients to include, promote and integrate their PSR with our Embark platform. This mitigates the risk of customers who need appropriate adjustments made and allows companies to proactively identify those who would benefit from registering on their PSR.

- Data sharing between creditors and debt advice providers is proving to be the most effective referral channel into debt advice. The debt advice integration within Embark is allowing customers to share their affordability data seamlessly with debt advisors. This has increased engagement by 20% when compared to traditional referral channels and reduced the time the journey takes from referral through to debt advice recommendation by four days, meaning more people are getting the right help and support at a crucial time.

- Income maximisation is becoming increasingly important to our clients, and they are continually looking at how they can improve their customer offering in this space. The use of the Embark workflow and affordability data is helping to automate the benefits check process for customers. Clients are able to see the positive impact of this through the data provided back and are able to help their customers achieve multiple positive outcomes in one, simple digital journey.

With the above examples, we have seen a real behavioural change with clients wanting to automate more but at the same time offer more support to their customers than they could have done previously.

To learn more about Embark, contact us or visit paylinksolutions.co.uk.