The ongoing Pandemic has seen upheaval across all sectors and many businesses have had to adapt their operations strategies at pace. From a collections perspective, Operations teams have also had to adjust rapidly, marrying evolving guidance from the regulator with new customer needs and expectations. These combined have resulted in a bow wave of operational volumes to contest with.

The complexity has been intensified, by Operations departments needing to manage the technicalities of enabling staff to work from home at short notice, alongside the personal and human challenges that come from staff home-working [and -schooling!] and many colleagues being on Furlough.

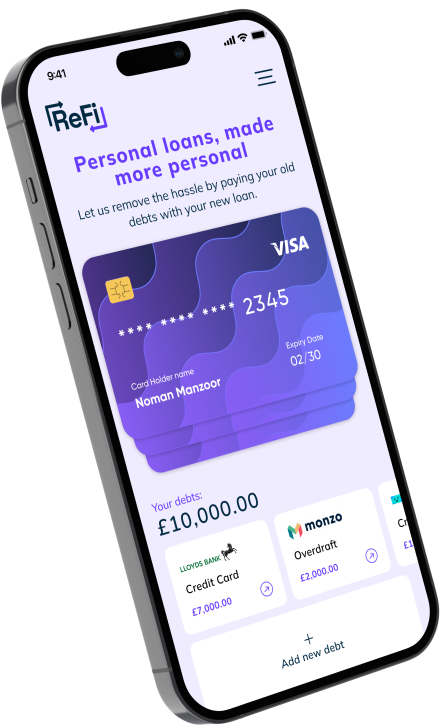

At Paylink Solutions we’ve been helping clients during Covid-19 and supported their collections processes through our software ‘Embark’. We’ve seen first-hand the operational challenges that have arisen from this pandemic and adapted our offering to help lenders overcome these hurdles.

What is clear is that the initial activity we have seen in the past 3 months, will not be a one-off and the demand for operational agility and flexibility will be required for the foreseeable future.

What has Pandemic taught us on how Collections Process need to change going forward?

There have been some structural shifts in how Collections departments will need to operate going forward.

As we head towards an economic downturn, I feel that there are five key themes or challenges that all Collections Operations should be preparing themselves for.

1. Operational Agility

Making sure you are operationally agile enough to be able to respond to a change going forward is essential! There are many changes still to arise from the current pandemic. Some known that you can plan for and others that will arise with no notice. These requirements may be internally driven; (cashflow or employee needs to name but two), or externally by the customer, regulator or even your competition.

However, the requirement for operational teams to work ever-closely with Risk, Finance and, Compliance Departments as well as their Third Parties, Technology & Product teams will be a sustained norm. Implementing modifications to existing processes or introducing new processes at speed is key and difficult to execute. It requires internal structural, governance and responsibility adjustments to be able to effectively deliver.

2. There is no one-size fits all

The requirement for increased Customer segmentation and the application of more bespoke collections strategies will only grow.

Where we’ve helped our Clients rapidly deliver bespoke Triage solutions, they’ve been centred around better understanding the customers personal circumstances, prior to them requesting a payment holiday. This helps hugely with any risk assessment processes and allows our Clients to deliver individual collections strategies, depending upon the outcome of the Triage.

3. Integration of new data sources

To facilitate the need for increased customer segmentation, new data sources need to be integrated into your collections ecosystem.

We’ve helped our Clients seamlessly integrate Open Banking and using this data to drive additional insights on their customers. The ability to see first-hand if your customer has received an income-shock or taken a payment holiday elsewhere is key enabler to deliver a more optimal outcome for both the consumer and the lender.

Key variables can also highlight customer vulnerabilities (temporary or permanent) and automate downstream sub processes.

4. Digital First

All collections strategies should be Digital first! There’s always going to be a need for contact centre and personal support, but the only way to manage bow wave in volumes is to deliver on the digital first premise.

No customer wants to sit through 4-hour call centre wait times, especially considering their personal circumstances and the additional challenges they must be facing right now! Some of our Clients have seen a 400%+ increase in volumes in Q2 this year and with repayment holidays being extended for another 3 months, additional dramatic fluctuations in volumes are still to come.

Whether it be digital triage solutions, chatbots, digital affordability assessments or digital collection of payments; we’ve supported our Clients manage their increased volumes seen throughout Covid-19 thus far, and these digital strategies can be adapted for future volume surges.

5. Those who are most vulnerable, require the fastest access to support

In my opinion, the true economic impacts of the Pandemic are still yet to materialise. Government intervention to date has been great at mitigating the current impact, but all our Clients are preparing for a wider downturn and reviewing their support and forbearance strategies. Many Clients are using our solutions to help identify customers who are vulnerable, and everyone agrees that these customers need access to support, from a combination of both internal and external sources.

In both my personal and professional life I’m a great believer in supporting those who are greatest in need. Thus, extending the digital journey to include direct digital integration with specialist providers, like Payplan, who can support them to me is a must.

Removing the need for vulnerable customers to go through multiple journeys and being asked the same repeated questions should be an absolute to allow these customers to get access to the support they need as quickly as possible.

The forthcoming downturn will also create customers who have never been vulnerable before, and their expectations of customer service and digital support will be very high.

The Pandemic is a great time to transform

Whilst the short to medium term remain uncertain, one thing is certain that there’s never been a better opportunity to drive and deliver transformation within Collections operations!

There is plenty of change yet to come, but the above themes give any business and more importantly their customers, the best possible chance of coming through this financially safe. Being able to execute the change at pace will be the key differentiator between success and just getting through.

I would be really interested to hear your views and please let me know if you feel that you would benefit from talking to Paylink and how we can support you during these challenging times.

Thanks for your time, Navdeep