Paylink Solutions recently posted an article highlighting what the development teams at Paylink are doing to help the banks and financial institutions deal with the peak in volumes of customers asking for payment holidays.

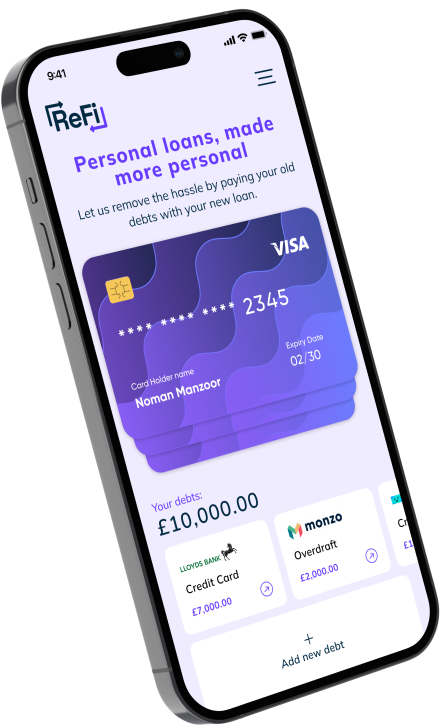

Customer Affordability at Your Fingertips

Our Embark for Collections product has been designed and developed to provide a seamless workflow for customers to digitally self-serve when providing the financial information required by the bank to gain a full picture of a customer’s affordability situation.

This allows the banks agents to quickly make an assessment which either results in an arrangement to repay the arrears or, where appropriate, a referral to Debt Advice.

Helping Fulfil the Regulatory Responsibilities of the Banking Sector

Our Embark solution has been designed to help businesses in the banking sector to fulfil their regulatory obligations by providing a full and accurate picture of a customer’s financial situation.

Our integration with Credit Bureaus and Open Banking API’s allow a user to access their full credit report and transactional bank data instantly, which in turn produces all the information needed to provide a full understanding of a customer’s incomings and outgoings.

At this point the customer can propose a repayment towards their arrears or, in cases where the customer is in financial difficulty, refer themselves for Debt Advice.

Across all our customers, on average, we have seen a 75% reduction in time that it takes an agent to gather the information via traditional methods.

Automated Features to support high volumes of Payment Holiday Requests

After close consultation with our clients to understand how they are looking to manage the recent surge in payment holiday requests, the teams at Paylink have designed additional automated features in Embark which will help replicate an outcome the agent in the bank would usually determine through a manual process.

Introducing our new bulk upload feature

Our ‘bulk upload’ feature will make it simple to upload and individually send affordability requests to your back book in one go, allowing you to tailor the messages in your requests depending on the segment of customers you are contacting. This can be done either daily or weekly and allows the bank to contact thousands of customers simultaneously.

Effective triage and automation for all customers coming to the end of ‘payment holidays’

Our triage functionality will allow the bank to handle those customers coming to the end of their 3-month payment break, differentiating between those who were in arrears pre Covid 19 and those who weren’t. The feature will allow the bank to ask certain questions designed to drive the right actions which will be predetermined by the banks policy, the outcome of which is that the customer either agrees to a new payment arrangement or they are asked to follow the process through Embark to complete an affordability assessment.

Our Embark summary page will then, after understanding the customers disposable income, either;

- Set up a revised payment and term to repay the arrears amount

- Allow the customer to refer themselves for Debt Advice

- Or refer themselves back to the bank to review the proposed payment arrangement

Read more here

The Bank can automate the request for any future affordability assessments

The last piece of functionality will allow the bank to automate the sending and analysis of future affordability assessments, by creating bespoke and unique plans per customer. This feature means the bank can automate future affordability checks for customers.

We have seen examples where customers have been granted a payment break, but the checks in 3 months are normally manual and labor intensive. Embark will allow the agent to determine the date (or dates) for future affordability requests to be made and will automate the sending and chasing of that information based on your process.

Our new functionality will include supporting large scale periodic campaigns for affordability assessments on your customer bases, the ability for that customer to propose a new repayment amount and date, and the future automation of the affordability checks moving forward.

For more information on all our existing and new features contact Richard Healey on richard.healey@paylinksolutions.co.uk

Want to See the Embark Platform in Action?

For a full demo of Paylink Solutions Embark platform and its huge list of capabilities for everything from the Lending sector through to Collections & Mortgages you can either contact myself, Susan Rann on susan.rann@paylinksolutions..co.uk or by visiting our Website and clicking “Request Demo”.