Paylink Solutions is driving change thanks to Embark, its industry-leading digital affordability journey, delivering record-high customer engagement and improved customer outcomes through secure data sharing between creditors and free debt advice provider PayPlan.

Over the past 12 months, there has never been a bigger spotlight on the need for households to understand their financial picture as the cost-of-living crisis and inflation continues to impact more and more people. And with that, the need for free debt advice has never been higher.

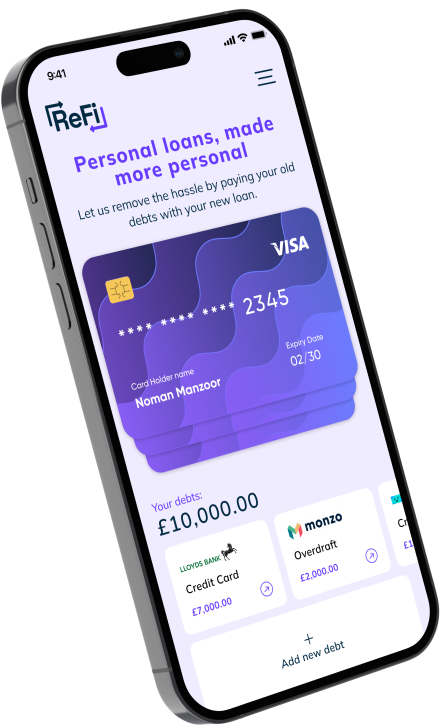

Embark, Paylink’s digital affordability product, is empowering creditors by enabling them to integrate their customers’ affordability data within PayPlan’s debt advice journey ensuring compliance with the FCA’s suggestions in their Consultation Paper CP23/13, which proposed that firms should provide customers with a comprehensive record of income and expenditure assessments, enabling them to share the information with other lenders and debt advice providers.

This has streamlined the debt advice process and helped thousands of customers take action and access the help they need more quickly. It has allowed customers to either use PayPlan’s live chat or call back service, with consent given to pass their budget information over via an API. This is the only solution in the industry which utilises shared customer affordability technology between creditors and debt advice.

Data from PayPlan shows that only 5% of customers would call PayPlan when verbally signposted by their creditor while, since the introduction of Embark, referrals have seen an increase of 27% in engagement, showing customers are more likely to take action and engage with the advice process when they are not having to repeat the I&E journey. Data has also revealed 78% opt to chat with an agent online rather than on the phone (22%) further highlighting the need for digital communications at a time that’s right for the customer.

One customer, Jason, found himself in trouble financially after he lost his job and started claiming universal credit. He had since found a new job but had accrued some debts while he was looking for work. Jason chose to contact PayPlan via live chat at the end of the Virgin Money Embark tool. Because he had already completed his income and expenditure, he received advice the very same day.

Jason had around £6,000 worth of debt and a disposable income of around £127, which meant he was unable to afford his contractual payments. PayPlan recommended a Debt Management Plan (DMP) and Jason made his first payment on his next pay day, just 22 days later, which is then distributed to each of his creditors on a pro-rata basis. Jason is looking forward to being completely debt free in around four years’ time.

Andrew Alder, of Paylink Solutions, said: “This is the perfect example of Embark’s unique integration with free debt advice provider PayPlan. Embark’s debt advice integrated into creditors’ software has made a tangible difference, acting as a one-stop shop for creditors and their customers alike. It has given PayPlan’s debt advisors a head start as they already know the financial situation of their customers, making the debt advice they provide even more tailored and effective.”

“PayPlan’s utilisation of Embark has also allowed their customers to share their open banking, credit reference agency data, and explore their unclaimed benefits entitlement in one workflow process provided by Paylink Solutions’ Embark product. And we’ve ensured that the Embark system is multifunctional and staff will have access to all its elements. This isn’t limited to a digital-only experience as Embark can be utilised by agents when going down the more traditional call route still required by some customers.”

Andrew Cameron, a senior PayPlan agent, said: “Debt problems can be daunting, so the easier we make it for customers to seek advice, the more likely they are to get the help they need. Already having the budget information from Embark saves us and the customer so much time when they approach PayPlan for debt advice.

“Customers who approach us directly often tell us they’ve already done an income and expenditure with their lender, but as they often don’t have a copy we have to start from scratch, which can be frustrating for the customer. With Embark, we just check the figures provided by the customer and get straight into their debt advice.”