18th March 2022.

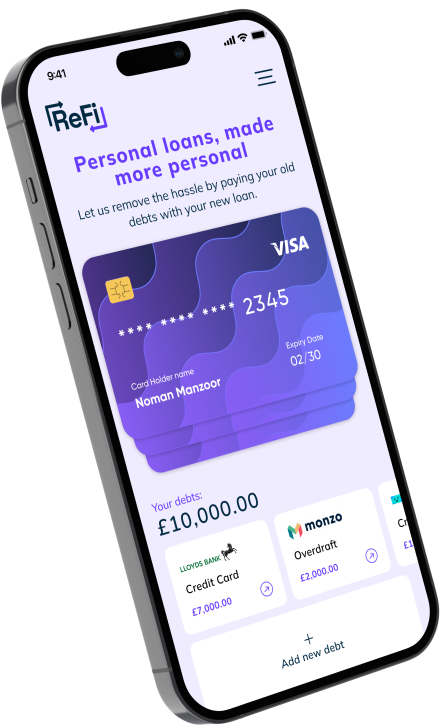

Clever Mortgages provides a comprehensive range of mortgages and protection policies, but specialises in working with those who have bad credit, debt or other more difficult financial situations.

The whole process of requesting and receiving details of customers’ financial circumstances was long and laborious, whilst they searched for all the relevant paperwork to then send in the post. This was causing inevitable delays to people’s mortgage applications.

Brokers also found it frustrating, as they waited for the information to arrive, to find that key documents were missing from the submissions. The whole process had to be repeated, which would temporarily halt the application.

Our experts worked closely with Clever Mortgages to understand the application process and build a platform which not only eliminates the need for paperwork, but also cuts out lengthy waiting times.

Clever Mortgages’ platform integrates Open Banking technology, so all financial information is pulled from people’s online bank statements and automatically inserted in the online income and expenditure form.

Brokers now also have access to leading credit referencing agencies and can instantly access credit reports, allowing them to immediately assess customers’ affordability. All they need to do is send a link to customers who can then provide all the information they need online.

All customers who have applied for a mortgage using the new process have given consent for their credit reports to be accessed by Clever Mortgages, meaning brokers can make much quicker and more informed decisions about the most suitable lenders to approach – in as little as one hour in some cases.

Sam Kirtikar, CEO of Clever Mortgages said: “Embark by Paylink Solutions drastically reduces the turnaround time of the application process for us and customers, which means we can provide more products to more people, without the need for additional resource. It’s reliable, quick and provides us with the exact information we need to identify a customers, assess their affordability and determine which are the most suitable products based on their circumstances.”