Following our recent post relating to mortgage payment holidays – where monthly mortgage repayments are paused for a set period of time to help those customers affected by the current Covid-19 situation – we set out the intentions of the Paylink teams to adapt our existing Embark platform to assist in the processing of applications.

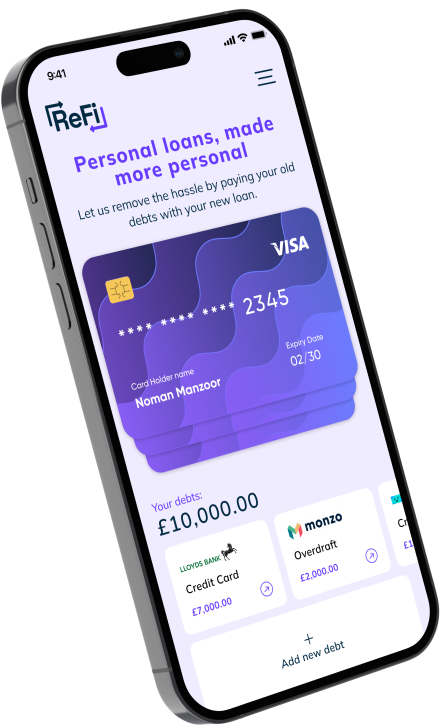

I’m pleased to announce we are now working closely with many of our customers to help them deal with the peak in volumes anticipated at the end of payment holidays. Our changes will mean consumers can access our affordability tool directly from their banking application, website or through chatbot, allowing them to set up a payment arrangement.

We will also create functionality for users or agents to reset a new workflow for a later date, meaning that those coming to the end of their payment holiday will automatically be sent a request to complete a new affordability assessment.

Both of these features will reduce the number of agents required to facilitate the peaks in volumes and gives the consumer a seamless journey through their channel of choice.

Aligned to this, the credit reference agencies Experian, Equifax and TransUnion have confirmed that homeowners will have their credit scores protected when they take out a mortgage payment holiday.

Contact us for more information and how we could help you