Background

Virgin Money (VM) wanted a digital affordability solution that could be used across all their consumer lending products following the coming together of VM, Clydesdale and Yorkshire Bank, creating the 6th largest UK bank. The coming together resulted in multiple CRM systems being used across different products and heritage brands.

After a rigorous tender process, Paylink’s Embark product was selected to provide VM with an ambitious affordability transformation programme to deliver a more efficient and accurate way of assisting customers in financial difficulty.

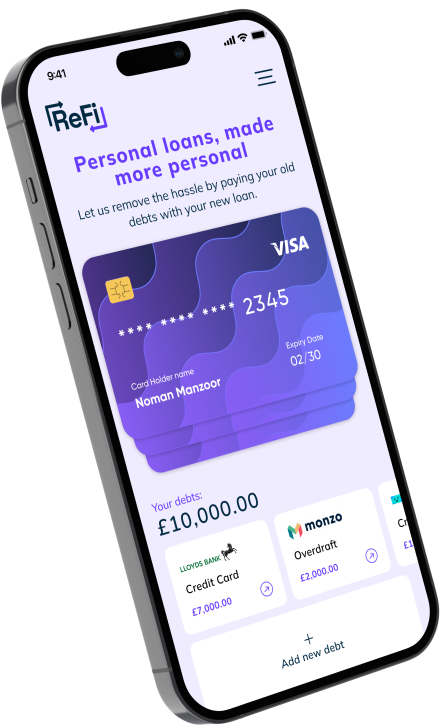

Paylink delivered a cloud-based digital income and expenditure (I&E) application that collects all relevant data to understand customers’ affordability, including their incomings, outgoings, and debts. The new platform, which helps VM to fulfil regulatory obligations, incorporates features including Open Banking, CRA, integration to debt advice and functionality so colleagues can use Embark on calls.

Customers can carry out their I&E via a self-serve portal or with a colleague. They can then be set-up with affordable and sustainable repayment plans in a faster, more accurate way.

Challenges and Objectives

The solution needed to not only include VM and its heritage brands,, but also a large part of VM’s unsecured collections activity which is outsourced to Arrow Global. It needed to be rolled out across all brands, products and teams spread across 4 sites.

Historically customers with multiple group products would have needed to complete an affordability assessment for each account. Embark improved the process, providing a single view of customer affordability and improving the customer experience across the entire Group, by only needing to carry out one affordability assessment for customers struggling across multiple accounts.

The key objective was to implement an open banking journey for customers struggling financially, to help make the experience more accurate, more personal and aligned to Virgin Money’s purpose of making customers happier about money. There had been no previous use case of open banking within the bank and this use case will be the test bed for the wider use of open banking within the Group.

Project teams on both sides worked at pace to deliver Embark into VM’s collections operating model within eight weeks. Due to the success of the rollout, hypercare support only needed to be provided by Paylink for two weeks (six weeks ahead of plan).

To encourage customers to use the solution and to maximise engagement, a content group was created to work collaboratively on the messaging used within the journey.

Over 250 colleagues were trained across all products and heritage brands including colleagues at Arrow Global on how to use Embark on calls, invite customer to self-serve and position the benefits of open banking.

Results and successes

Within the first four months of implementation, over 5,000 digital affordability assessments were completed.

3000+ customers provided their consent for VM to access their credit file information within the affordability. This supported the bank in providing outcomes which took into consideration the customer’s holistic situation whilst embodying VM’s purpose of making customers happier about money.

As a result, VM were able to realise significant benefits by achieving six figure reduction operating costs within first 6 months and with average handling times of affordability assessments reducing by 40%

Nick Watson, Head of Collections at Virgin Money, said: “Embark has been a game changer and allowed us to streamline our affordability processes, align our teams, provide new ways for customers to engage whilst reducing cost / creating capacity just at the right time as the cost of living challenges take hold. A great example of our purpose in action by making our customers happier about money”