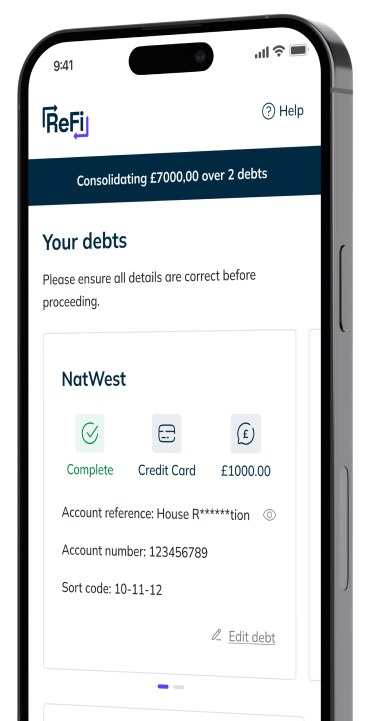

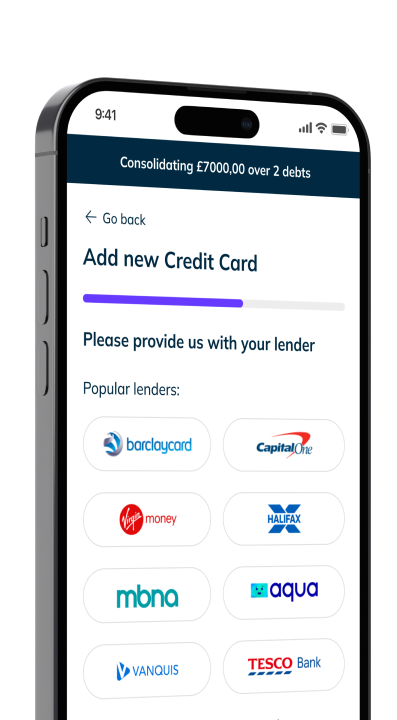

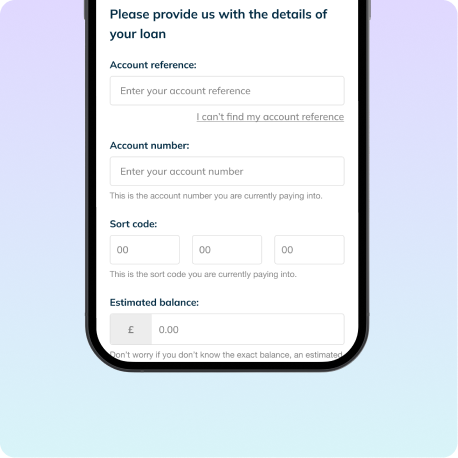

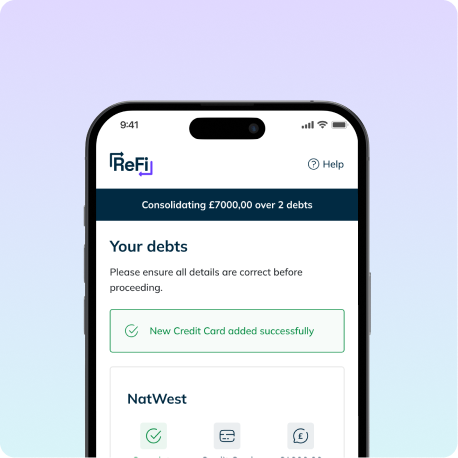

ReFi is a seamless digital journey which validates the card, loan and overdraft products a customer currently holds. It confirms balances and settlement amounts, pays creditors directly, and if instructed to do so, evidence that these accounts are closed.

ReFi is a unique, safe and secure way to ensure a new loan that works for a customer. It is the UK’s first True Debt Consolidation product, already saving UK customers millions of £’s in interest.

Build brand advocacy from the customers who you help to improve their financial health.

Customers will save time and reduce hassle of dealing with multiple financial institutions.

Credit allows families to manage costs, realise opportunities and pursue financial objectives. It is especially valuable during tough times.

Being granted credit is not a right. Before accepting a new customer, lenders have to be certain that their product is affordable for the customer.

ReFi is a unique, safe and secure way to ensure a customer’s new loan improves their financial position